Real Client Accounts - Not Virtualized

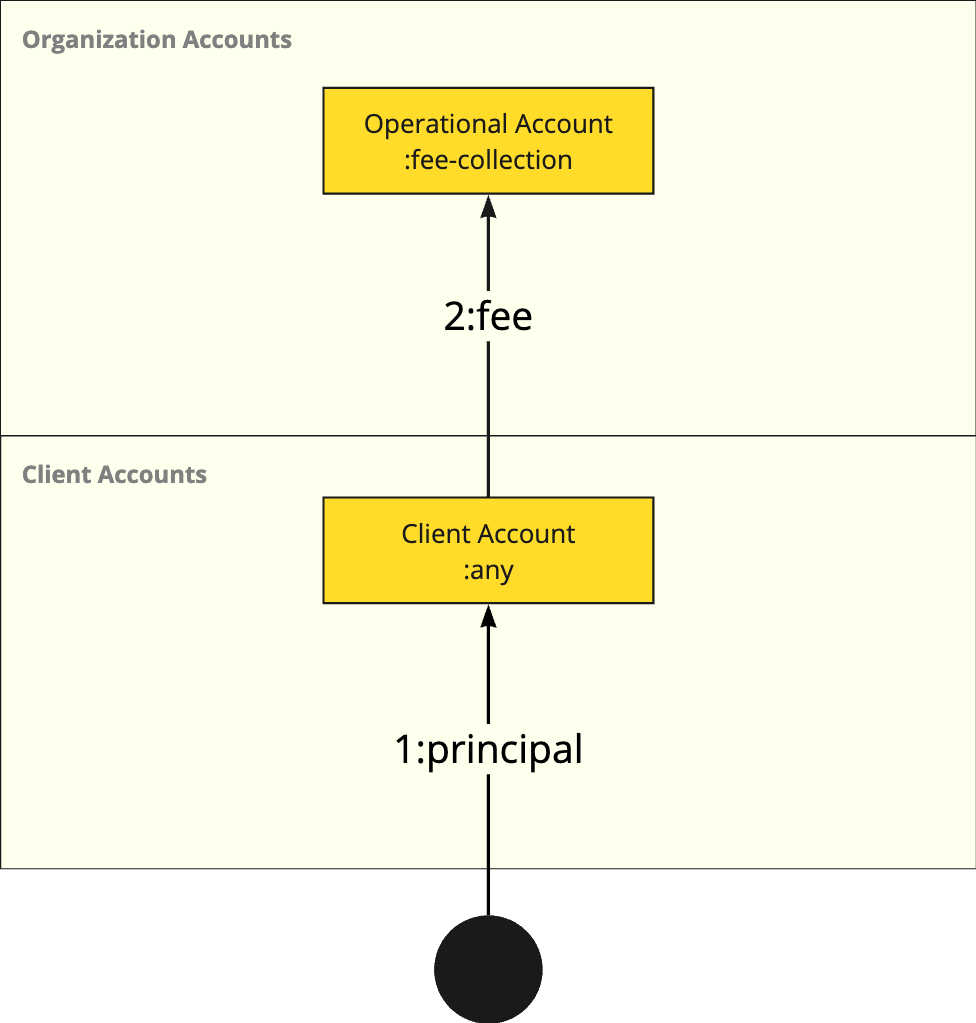

Client External Incoming Transfers

A client incoming transfer of 100 GBP is received and there will be 5 GBP fee.

Funds flow on the service provider:

Balance changes with the timeline:

| Timeline | Client Account - SP | Client Account - IF | Fee Collection Account - SP | Fee Collection Account - IF |

|---|---|---|---|---|

| T0 | 0 | 0 | 0 | 0 |

| T1 | 100 | 0 | 0 | 0 |

| T2 | 100 | 95 | 0 | 0 |

| T3 | 95 | 95 | 5 | 0 |

| T4 | 95 | 95 | 5 | 5 |

- T0: Fee Collection Account is an organization account. Client Account is an account belongs to a client. All accounts have 0 balance.

- T1: An incoming transfer of 100 is sent to a client IBAN / account number. Client Account on SP side is credited by 100.

- T2: IF Platform detects the incoming funds via webhook or polling. A provisioned account credit record is created and matched with a client IBAN / account number. Then, the incoming transfer record is created and Client Account by 95 because of the fee.

- T3: After the completion of the client incoming transfer, fee collection is handled instantly. This process creates an internal outgoing transfer from Client Account to Fee Collection Account on IF side. Outgoing transfer to collect the fees is released the service provider. Service provider debits Client Account by 5 and credits Fee Collection Account by 5 in its own records.

- T4: IF Platform detects the internal incoming transfer to Fee Collection Account and credits the account by 5 on its own records.

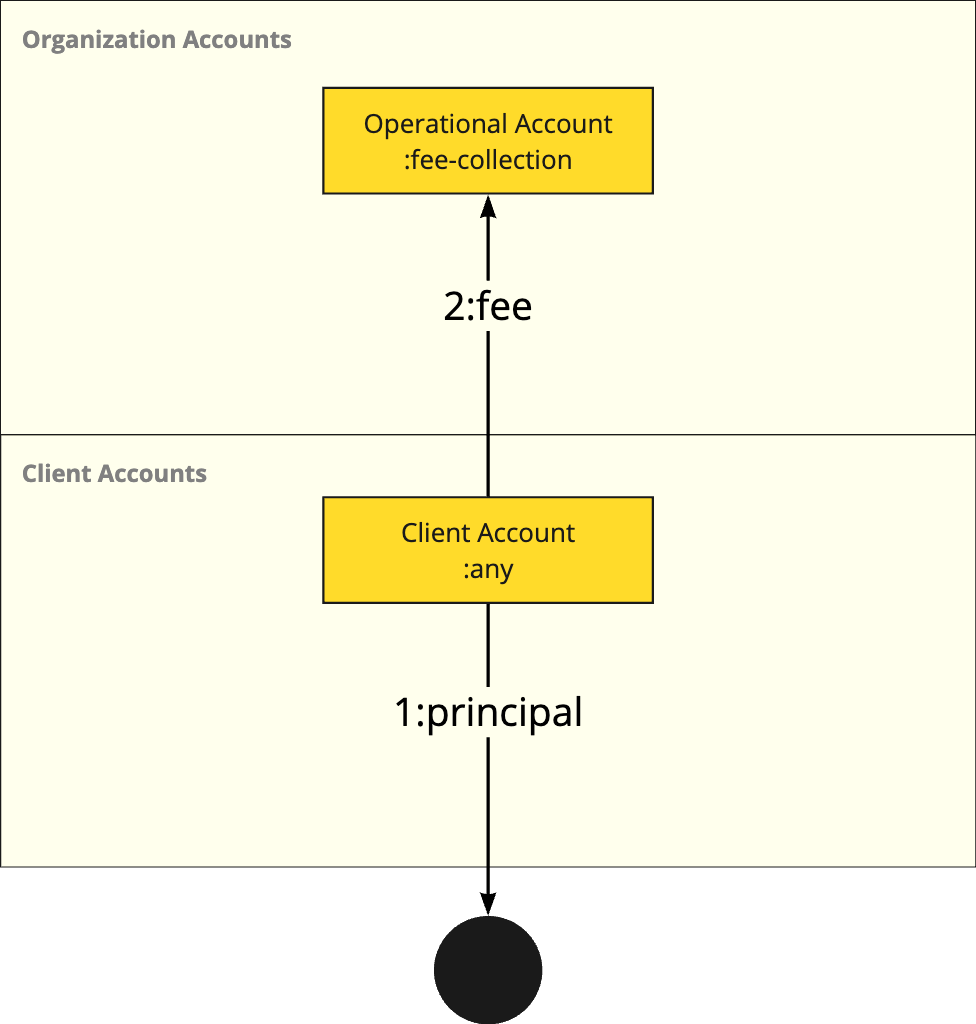

Client External Outgoing Transfers

A client outgoing transfer of 50 GBP is created and there will be 10 GBP fee.

Funds flow on the service provider:

Balance changes with the timeline:

| Timeline | Client Account - SP | Client Account - IF | Fee Collection Account - SP | Fee Collection Account - IF |

|---|---|---|---|---|

| T0 | 95 | 95 | 5 | 5 |

| T1 | 95 | 35 | 5 | 5 |

| T2 | 45 | 35 | 5 | 5 |

| T3 | 35 | 35 | 15 | 5 |

| T4 | 35 | 35 | 15 | 15 |

- T1: Client account balance on IF side is debited by 60 while transitioning from pending to processing..

- T2: Transfer is released to the service provider. The service provider debits the Client Account by 50 and transfer is updated as completed.

- T3: After the completion of the client incoming transfer, fee collection is handled instantly. This process creates an internal outgoing transfer from Client Account to Fee Collection Account on IF side. Outgoing transfer to collect the fees is released the service provider. Service provider debits Client Account by 10 and credits Fee Collection Account by 10 in its own records.

- T4: IF Platform detects the internal incoming transfer to Fee Collection Account and credits the account by 10 on its own records.

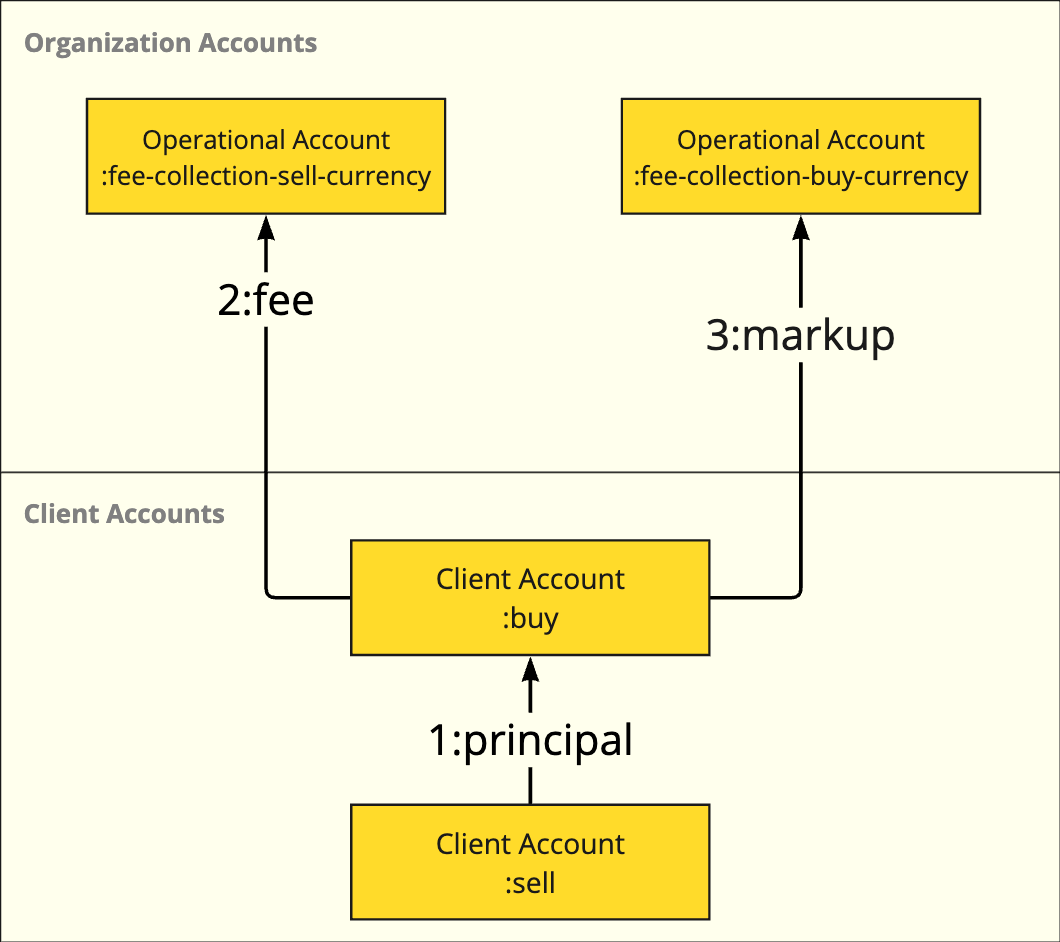

Client Exchange Transactions

A client exchange transaction to sell 100 EUR to buy GBP is created.

Service Provider offers 83 GBP for 100 EUR. Service provider rate: 0,83

IF Platform adds markup and transparent fee to the service provider offer.

IF Platform offers 80 GBP for 100 EUR to the end user. Client rate: 0,81. So, 2 GBP will be markup profit and 1 GBP will be transparent fee.

Funds flow on the service provider:

Balance changes with the timeline:

| Timeline | Client Account - EUR - SP | Client Account - EUR - IF | Client Account - GBP - SP | Client Account - GBP - IF | Fee Collection Account - GBP - SP | Fee Collection Account - GBP - IF |

|---|---|---|---|---|---|---|

| T0 | 100 | 100 | 35 | 35 | 15 | 15 |

| T1 | 100 | 0 | 35 | 35 | 15 | 15 |

| T2 | 0 | 0 | 118 | 35 | 15 | 15 |

| T3 | 0 | 0 | 118 | 115 | 15 | 15 |

| T4 | 0 | 0 | 115 | 115 | 18 | 15 |

| T5 | 0 | 0 | 115 | 115 | 18 | 18 |

- T1: Client account balance on IF side is debited by 100 EUR on exchange transaction creation.

- T2: The exchange is booked at the service provider. The service provider debits the sell side by 100 EUR and credits the buy side by 83 GBP on transaction completion.

- T3: Once IF Platform receives the updates from the service provider, transaction is marked as completed and the Client Account on the buy side is credited by 80 GBP because of markup & fee.

- T4: After the completion of the client exchange transaction, fee collection is handled instantly. This process creates an internal outgoing transfer from Client Account to Fee Collection Account on IF side. Outgoing transfer to collect the fees is released the service provider. Service provider debits Client Account by 3 and credits Fee Collection Account by 3 in its own records.

- T5: IF Platform detects the internal incoming transfer to Fee Collection Account and credits the account by 3 on its own records.

Updated 4 months ago